Know Your Rights

Quick Contact

"*" indicates required fields

Know Your Rights

The Fair Debt Collection Practices Act (FDCPA) was passed to eliminate abusive practices in the collection of consumer debts, promote fair debt collection, and provide consumers with a way to dispute and obtain validation of debt information to ensure the information’s accuracy. The Act creates guidelines regarding how debt collectors may conduct business, defines the rights of consumers involved with debt collectors, and sets penalties and remedies for violations of the Act.

If you are being harassed by a debt collector, FDCPA attorney Robert W. Murphy can put an end the harassment and help you receive monetary compensation. If the harassment has been egregious, your compensation can be substantial.

The Fair Debt Collection Practices Act prohibits all of the following debt collection activities:

- Harassing, oppressive or abusive conduct

- Repeated phone calls or calling at unreasonable times

- Continuing to contact you if the collector knows you have hired an attorney

- Contacting you at work despite the collector knowing you are not allowed to take calls of this nature while working

- Contacting employers, relatives, neighbors or any third party (other than your spouse) for information about the debt

- The use of threats (such as garnishing wages, referring your case to a lawyer, repossessing property or damaging your credit rating) without any intention of actually doing so

- The use of profane or obscene language

- Threatening you with violence

- Continuing to pursue the debt even though it has been properly disputed

- Sending phony documents or letters that appear to be from a court or government agency

- Trying to obtain collection fees, taxes or interest charges that exceed, or are not permitted by, your contract or state law

- Falsely representing herself/himself in order to collect the debt (such as using a fake name or claiming to be a lawyer)

- Suing you in a court that is located too far from your place of residence

- The use of false claims to gather information, such as stating that he or she is conducting a study or survey

- Contacting you despite the fact that you have notified the debt collector in writing to halt all communication

- Threatening to having you arrested or imprisoned

- Falsely representing the amount, legal status or character of your debt

- Requesting you to provide post-dated checks with the goal of prosecuting you if the checks bounce

- Communicating to you with a postcard

It is important to note that if you notify the debt collector within a 30-day period that the debt is disputed, or you request the name and address of the original creditor, the debt collector is required to cease collection of the debt until he or she obtains verification of the debt or the name and address of the original creditor, and provides you with this information.

If you believe your rights under the Fair Debt Collection Practices Act are being violated, contact our FDCPA attorney today for an evaluation of your case. We can put an end to the harassment and help you obtain compensation for the harm done to you.

In most cases, we will not charge you unless we obtain compensation on your behalf.

About Us

Robert W. Murphy

Consumer fraud attorney Robert Murphy is a trial lawyer who practices in the areas of consumer litigation throughout the United States. In nearly 40 years of practice, he has actively litigated cases under almost every aspect of federal and state consumer protection laws, including the Fair Debt Collection Practices Act (FDCPA). He has acted as lead counsel in the litigation of cases both individually and on a class basis in venues across the country. He is dedicated to advancing the consumer rights of Americans through both courtroom advocacy and the education of families and individuals concerning consumer protection laws. Read more…

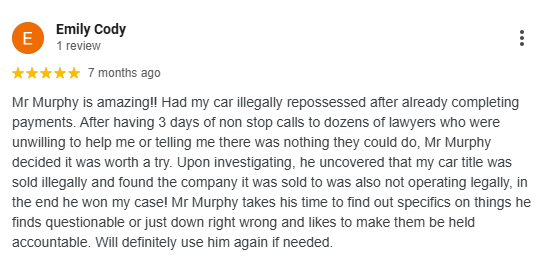

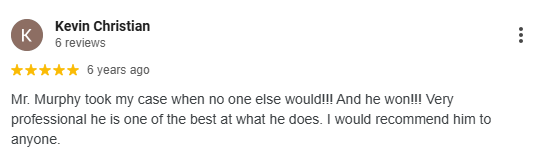

Here's What People Are Saying About Murphy Law:

CONTACT US TODAY!

If you have been the victim of unlawful fraud or repossession, contact a consumer rights attorney at Murphy Law today.

Contact Information

- Contact Information

219 Davie Boulevard

(aka 219 SW 12th Street)

Fort Lauderdale, FL 33315

- Phone

- Fax

(954) 763-8607

Send Us A Message

"*" indicates required fields